Summary

- Digital Transformation is vital for survival and high on the agenda for almost all organisations across all industries

- Companies that undergo effective digital transformation drive more revenue out of their assets and achieve higher financial performance and valuations

- Digital transformation is becoming an increasingly important value lever for private equity firms – both in terms of how they validate their investment thesis as well as by digitising their own operations

- However even if there is willingness to adapt, most digital transformations fail due to unclear digital roadmaps, poor transformation management and a lack of technical capability for effective execution

- Organisations need a clear strategy for conducting any digital transformation for investments in digital tools to have a high ROI – collaborating with external partners (like IMS) is a potential route for traditional companies to ‘level-up’ digitally

Digital Transformation is vital for survival and high on the agenda for almost all organisations across all industries

Most traditional organisations have not conducted meaningful digital transformation, however there is increasing appetite for it.

- Despite the information technology revolution in Silicon Valley having occurred all the way back in the 90s and multiple technology companies have broken the $1trn market cap threshold in that time, few companies can claim to be truly tech-enabled – especially those in traditional industries such as real estate, manufacturing, and logistics. Research by SAP found that only 3% of companies had completed any company-wide digital transformation effort1.

- While there have been a few notable success stories such as Nike, Target and DBS Bank, most traditional companies are still dependent on manual processes.

- Traditional firms also tend to be using legacy software, which suffer from increased cybersecurity risk, outdated functionality, and incompatibility with newer technologies. Even if these legacy solutions are well-built, its usage typically hasn’t been well-planned and, in many cases, software doesn’t seamlessly link into other solutions or into current internal processes. These solutions are rarely ‘future-proof’ as they struggle to keep up with rapidly changing business needs – most of the IT effort for these firms is spent managing complexity rather than envisioning innovative initiatives to keep up with the times.

Rather than conducting large-scale investment in digital transformation to address operational squeezes, Asian business leaders have typically hired more labour instead

- While these issues apply on a global context, they are even more pronounced in the Asian market where it is common for employees to say that their ways of working have hardly changed in the last few decades with many high-profile companies still dependent on paper-based documentation. Rather than conducting large-scale investment in digital transformation to address operational squeezes, Asian business leaders have typically hired more labour instead. This has meant that Asian corporations are seen to be far behind Western markets such as the US.

- However, this mindset has been changing as industry leaders begin to understand the urgency of digitalising their operations and prioritise digital transformation, with 84% of global companies regarding digital transformation as crucial2 and 70% of mid-market and large corporates in the APAC region now having a digital transformation strategy in place3.

- Digital Transformation is critical for traditional organisations to keep up with competition and avoid getting disrupted by tech-enabled startups.

- Digital transformation is now more and more accessible to non-tech firms. Recent developments, especially in cloud computing, have opened the door for non-tech firms to invest in technology at scale. In the past, firms seeking to adopt digital technology had to make large investments in data infrastructure and hardware. Now they have alternative options such as renting data infrastructure from service providers such as Azure and AWS4, as well as high-functionality enterprise technology solutions from vendors such as Salesforce.

- With more companies investing in digital tools and an increased focus across most companies on becoming more tech-enabled, it is critical for all companies to urgently invest in their own digital transformation initiatives to keep up with their competition and not be left behind.

In an increasingly ‘winner-takes-all’ business landscape, corporations that are run in an industrial-era manner will be competed away by those that have embraced digital change

- In an increasingly ‘winner-takes-all’ business landscape, corporations that are run in an industrial-era manner will be competed away by those that have embraced digital change. It is like bringing a knife to a gun fight. Digitally enabled companies can move more quickly, operate more efficiently, mobilise more resources, attract more talent and win over customers more readily5.

- Traditional players typically have an incumbency advantage, in which they can leverage factors such as a wide customer base, brand recognition and a track record; these act as barriers to entry against disruptive tech-enabled start-ups.

- However, if a corporation or an industry fails to digitise to a sufficient degree, it can leave them open to disruption as start-ups use technology to reimagine the entire customer and employee experience.

- There are many famous examples of corporations failing to digitise and subsequently being forced out of business in a very short period, with an especially well-known story in Blockbuster which failed to embrace digital change and was subsequently ill-equipped to cope with the streaming revolution led by players such as Netflix and Hulu. This rapid disruption has the potential to occur across all industries, regardless of current market position and strength.

If a corporation or an industry fails to digitise to a sufficient degree, it can leave them open to disruption as start-ups use technology to reimagine the entire customer and employee experience

Companies that undergo effective digital transformation drive more revenue out of their assets and achieve higher financial performance & valuations

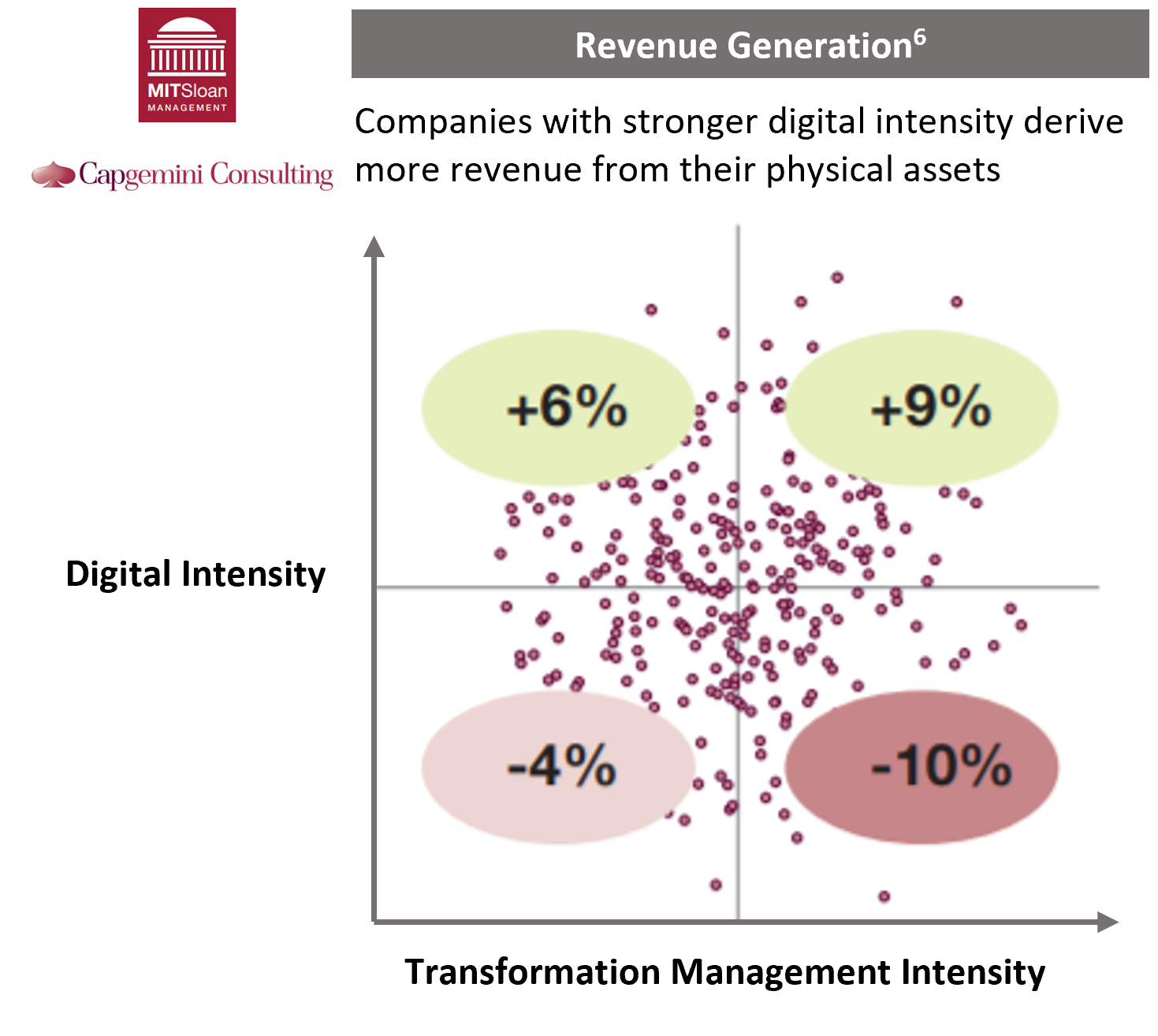

- Companies with stronger ‘digital intensity’ – technology-enabled initiatives that change how the company operate – can drive more revenue with existing physical capacity and can scale faster.

Basket of indicators:

-

Revenue/Employee

-

Fixed Assets Turnover (Revenue/ Property, Plant & Equipment)

- Digital transformation leads to improved profits for c.80% of companies that pursue it1. Some of the reasons behind this are:

- Increased operational capability: Significant efficiency and productivity gains possible through digital tools that automate manual tasks, improve resource planning and increase visibility across firm operations

- Improved collection & utilisation of customer data: Optimised sales & customer management through data driven insights and personalisation

- Facilitation of shift to platform model, with network effects: Facilitating interactions across a large number of participants (e.g. social network, ecommerce platform) offers business a highly scalable model that allows them to grow rapidly as well as hedging against the risks posed by an uber-isation of the economy

- Tech companies and tech-enabled companies typically have higher multiples as investors see these companies as well-placed to capitalise on market opportunities, achieve faster growth and endure into the future.

- A successful digital transformation push in traditional firms has also shown to strongly increase valuations – MIT & Capgemini research shows that companies with well-planned transformation programmes are more profitable and achieve higher market valuations6. Due to a combined effect of revenue growth, margin expansion, multiple expansion and higher dividends, valuations of US firms that go digital are 7% to 21% higher than those of their peers4, with high performing companies achieving far higher increases.

A successful digital transformation push in traditional firms has also shown to strongly increase valuations due to a combined effect of revenue growth, margin expansion, multiple expansion and higher dividends

Target, a legacy brick & mortar big box retailer, that was saddled with outdated legacy technology has undergone a transformation into an omni-channel retail innovator with a thriving e-commerce channel. Leveraging predictive analytics and machine learning, Target’s online delivery services drove revenue increases in 2020 of more than $15bn – more than the 11 prior years combined7. Its highly successful digital transformation, in which e-commerce is increasingly important to its business model, has meant that Target’s valuation has increased by c.4.5x from 2017 to 20218, at a time when many other traditional retailers have been going out of business due to COVID-19 pressures.

Nike, typically dependent on a brick & mortar model, decided on a ‘digital-first strategy’ in 2017 that shifted its focus to e-commerce, with a focus on a data-driven model for a highly personalised customer experience. it also invested in a predictive analytics platform Celect, which is integrated into Nike’s apps and websites, and a Nike Training Club platform, which has over 100m members9,10. This company-wide digital transformation has increased Nike’s valuation by c.3x since it announced its initiatives in 2017, a far better return than those achieved by Adidas (c.1.5x), Skechers (c.1.75x) and Under Armour (1.2x) in the same period8.

4Korn Ferry an executive search and management consulting company that rolled out its Talent Analytics product in 2014, improved its valuation by over 60% (increase in market-to-book ratio from 1.21 to 1.94) in the same year.

4Caterpillar, a manufacturer of construction equipment, made significant investment in automated analytics and diagnostics in 2015 and saw its price-to-earnings ratio go from 15.0 to 18.8 that year, an increase of 25%.

- This ‘valuation bump’ is also applicable to firms in the Asian market that have successful undergone digital transformation.

11DBS Bank, founded in 1968 in Singapore, decided in 2009 to undergo a transformation into transitioning into a technology-driven digital bank. These initiatives include:

- Transitioning more than half of its customers to banking via its digital channels. For DBS, these digital customers are twice as profitable as traditional customers

- Launching an API platform, allowing financial and retail partners to invisibly integrate DBS’ capabilities into their systems (more than 400 partners were connected in 2019)

- Moving more than 2/3 of its applications to the cloud to provide greater flexibility

- Being open to working with start-ups and embracing high quality solutions that come from the ecosystem

From 2009 to 2019, DBS delivered a Total Shareholder Return of 162% while the broader Singaporean stock market only delivered 62%.

Digital transformation is becoming an increasingly important value lever for private equity firms – both in terms of how they validate their investment thesis as well as by digitising their own operations

- Typically in the past, most private equity firms looked to create value in portfolio companies by focussing on either cost cutting and creating operational efficiencies or revenue uplift through sales optimisation, and expansion into new geographies, product lines or verticals.

- However, digital transformation is now increasingly becoming one of the most vital levers for value creation in the portfolio companies of PE firms – a successful digital transformation programme can lead to significantly higher returns on investment through a mixture of top-line growth, operational improvement, and multiple expansion. PE firms are increasingly looking to validate their investment thesis through the digital lens. PE firms risk getting left behind competitors if they don’t come in to their deals with a clear digital transformation agenda for portfolio companies, along with the technical resources and knowledge they can lean on to actually deliver it.

A successful digital transformation programme can lead to significantly higher returns on investment through a mixture of top-line growth, operational improvement, and multiple expansion.

- On top of digitally transforming portfolio companies, the industry itself has begun to digitise. Historically, PEs have relied on institutional knowledge, contact networks and intuition to spot opportunities and predict future trends. PE houses have increasingly been looking at the potential of technology to automate workflow processes, improve fund accounting and reporting, streamline due diligence and analyse large datasets. It may not be a decisive competitive pressure now but as the digital tools become increasingly optimised, private equity firms that adopt a more digital model will able to run their operations more efficiently, pick better investments and subsequently generate outsized returns on their capital.

- These trends have been just as strong in the APAC region, with 60% of PE firms seeing digital transformation as key for their portfolio companies in the post-Covid-19 era14.

However even if there is willingness to adapt from traditional companies and private equity firms, most digital transformations fail due to unclear digital roadmaps, poor transformation management and a lack of technical capability for effective execution

- As firms underinvest in technology, they build up a tech debt (the accumulation of all technology work a company needs to do in the future), with the ‘interest’ (resources spent on dealing with the increased complexity associated by old and outdated systems) constantly accumulating. In a McKinsey survey, 60% of CIOs reported that this tech debt had markedly risen over the past three years; this suggests a significant underinvestment in digital transformation by the majority of firms14.

”The majority of corporations are ‘under-investing in innovation, skilled workforce or essential capital expenditure

Larry Fink, CEO of BlackrockThe world’s largest institutional investor

- Even amongst firms that show a strong willingness and up-front commitment to invest in digital transformation, most corporate digital transformation projects fail because of a lack of expertise and the fact there are ‘few signposts’ guiding them on conducting it effectively. This is especially the case in the Asian market.

- The highly publicised stories of Silicon Valley are far removed for an executive of a traditional organisation sitting in Hong Kong or Kuala Lumpur, which are typically slow moving and have business structures that aren’t primed for digital transformation. Publicised stories and research are centred around implementing ‘super-advanced, new-age tech’ and not relevant to the more standard digitalisation initiatives (e.g. Cloud infrastructure, E-commerce, CRM, accounting etc.) that executives of more traditional firms are focussed on.

- Even if the firm understands the roadmap it needs to take with regards to digital transformation, strong ‘transformation management’ – the leadership capabilities needed to drive digital transformation (vision, governance, strong IT/business relationships etc.) – is required. If a firm can’t ensure that the digital initiatives interact seamlessly with each other and with business processes, as well drive usage and adoption amongst the firm, then investments will fail to pay off. Digital transformation also needs to be effectively scoped from a technical perspective by industry-leading talent. Without the best minds understanding the current systems and enterprise requirements, there is a danger of excessive complexity in products, processes and applications, which can create an inflexible and non-scalable technology stack that cannot adjust to changing business needs.

- Even if the firm understands its roadmap and is perfectly set up to leverage digital tools to its maximum potential, it can be difficult to make this a reality as traditional firms typically lack the technical talent and expertise required to make this a success. Even the majority of Asian PEs, who consider digital transformation as the most important lever, do not feel capable of delivering transformations with their own resources15.It is incredibly tough to hire top-tier tech talent into a non-tech company and this is especially the case with the modest tech talent pool in Asian countries.

It is incredibly tough to hire top-tier tech talent into a non-tech company and this is especially the case with the modest tech talent pool in Asian countries

Organisations need a clear strategy for conducting any digital transformation for investments in digital tools to have a high ROI – partnering with third-party advanced tech agency (like IMS) is a potential route for traditional companies to ‘level-up’ digitally

- 6For a successful digital transformation, executives need to:

- Clearly understand it’s current state and the existential threats the company faces

- To identify priority areas that a company needs to excel in (e.g. customer management, e-commerce capability etc.)

- Effectively plan how a digital transformation is structured into business processes

- Obtain buy-in and support from the organisation at an early stage

- Hire the right people and third-party specialists to fill any capability gap

- Consistently quantify and monitor progress from a birds-eye view to ensure effective implementation

- While it is possible to attempt to plan and conduct digital transformation using only in-house resources, utilising industry-leading third party solutions and partnering with advanced tech agencies, such as IMS, is an effective way for traditional corporations and private equity firms to rapidly fast-track technological development and hedge the risks of digital transformation. Working with third party agencies is a way for companies to utilise tech talent that they would have been unable to acquire themselves and leverage an experienced team (of scalable size) that has completed multiple similar projects in the past. These high-calibre teams will be able to drive strong ‘transformation management’ and ensure that any initiative is properly scoped and planned. However, these agencies need to be carefully examined to see if they possess high quality in-house architects and developers as well as investigated on their track record on similar projects with other companies.

Partnering with advanced tech agencies, such as IMS, is an effective way for traditional corporations and private equity firms to rapidly fast-track technological development and hedge the risks of digital transformation.

Kroger partnered with Ocado to create automated online grocery warehouses powered by Ocado solutions. Through this partnership, Kroger were able to skip multiple years of development and guarantee an effective grocery fulfilment offering. The partnership contributed to a 92% e-commerce gain in one year (‘19-‘20) 16.

About IMS

IMS is Hong Kong’s leading Digital Transformation Agency with over 300 employees in Hong Kong, Guangzhou, Shanghai and Singapore. IMS helps corporates and private equity firms accelerate their growth through the conceptualisation and deployment of their digital strategy. The firm offers end-to-end digital services spanning from digital marketing and digital transformation to advanced data analytics. Recent clients include HSBC, FoodUnion, Töpfer and Engel & Völkers.

IMS Digital Ventures, the venture building arm of IMS, builds revolutionary new ventures with Asia’s most influential corporations and disruptive entrepreneurs. IMS DV is a member of Global Startup Studio Network.

References

- SAP – 4 Ways leaders set themselves apart

- SAP – New report looks at successful digital transformation | The Horizons Tracker (adigaskell.org)

- DBS – Digital transformation remains core agenda for large corporates, middle-market companies and SMEs in Asia-Pacific (dbs.com)

- HBS – Going Digital: Implications for Firm Value and Performance

- Forbes – Why Digital Transformations Are Failing (forbes.com)

- Capgemini, MIT– The Digital Advantage: How digital leaders outperform their peers in every industry

- Intelligent Automation Network – Retail Reimagined: A Look at Target’s Digital Roadmap | Intelligent Automation Network

- Google Stocks

- CMC Markets – How is digital transformation lifting Nike’s share price? (cmcmarkets.com)

- Rangle – How Nike’s digital transformation helped them thrive during Covid-19 | Rangle.io

- Innosight – ASEAN’S TRANSFORMATION CHAMPIONS | Innosight

- PwC – Q&A: Digital opportunity and maturity in private equity portfolio companies — Financier Worldwide

- PwC – Intelligent automation and analytics in private equity — Financier Worldwide

- McKinsey – Tech debt: Reclaiming tech equity | McKinsey

- Oliver Wyman – Asian private equity investors focus on business transformation | Asia Asset Management

- CNBC – Kroger lifts annual forecasts with online grocery sales booming (cnbc.com)